The Most important Thing in Beating the Market According to Warren Buffet

Anybody can get exceptional return on the stock market by following this Warren Buffet advice

What is the most important thing in getting an exceptional return on the Stock Market in a fast changing world?

A Georgetown University student once asked Warren Buffett this question. Warren replied:

The Oracle of Omaha

The most important thing is to be able to define which companies you can come to an intelligent decision on and which ones are beyond your capacity to evaluate. You don’t have to be right about thousands and thousands and thousands of companies. You only have to be right about a couple.

I met Bill Gates on July 5th, 1991. We were out in Seattle, and Bill said you’ve got to have a computer. And I said, why? And he said, well, you can do your income tax on it. I said, I don’t have any income. Berkshire doesn’t pay a dividend. He said, well, you can keep track of your portfolio. And I said, I only have one stock. And he says it’s gonna change everything. I said, well, will it change whether people chew gum? And he said, well probably not. And I said, will it change what kind of gum they chew? He said no. I said well then, I’ll stick to chewing gum, and you stick to computers.

You know, I don’t have to understand all kinds of business. There’s all kinds of business I don’t understand. But there’s thousands of opportunities out there. I did understand the Bank of America. And I’m able to do that. I’m able to understand some given percentage.

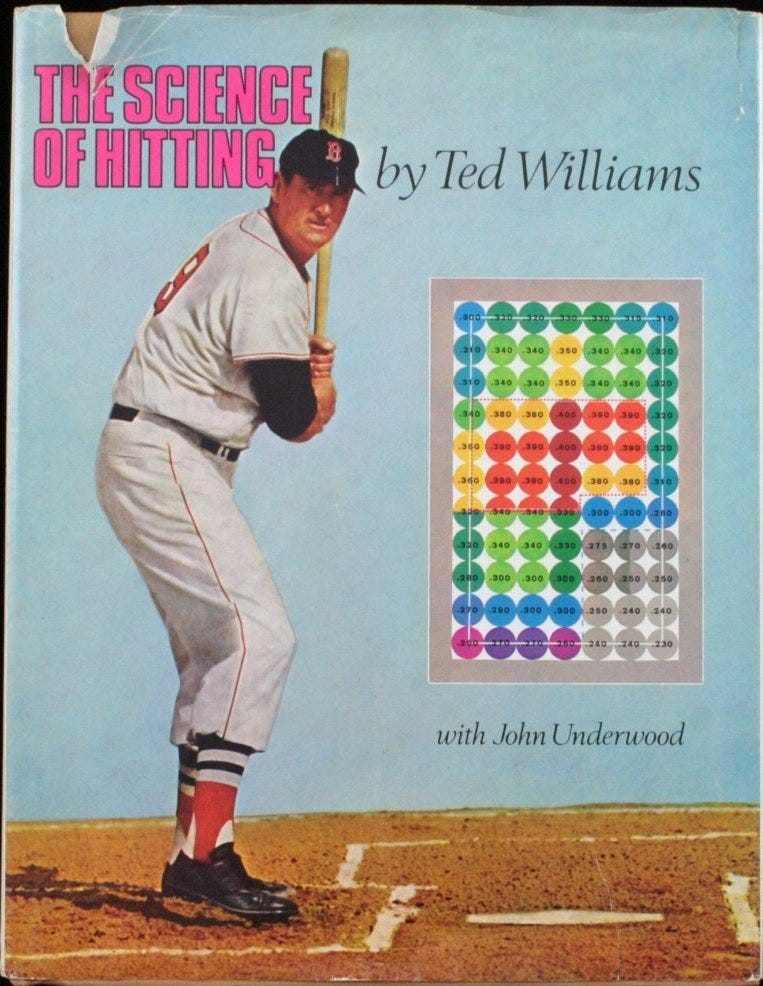

Ted Williams wrote a book called The Science of Hitting. And in The Science of Hitting, he’s got a diagram which shows him at the plate, and he’s got the strike zone divided into 77 squares, each the size of a baseball. And he says, if I only swing at pitches in my sweet zone, which he shows there, his batting average would be 400. If he had to swing at low outside pitches, but still in the strike zone, his average would be 230. He said the most important thing in hitting is waiting for the right pitch. Now he was at a disadvantage because if the count was zero and two or one or so on, even if that ball was down where he was only gonna bat 230, he had to swing at it.

In investing, there are no called strikes. People can throw Microsoft, General Motors or any stock at me, but I don’t have to swing. Nobody’s gonna call me out on called strikes. I only get a strike called if I swing at a pitch and miss.

So I can wait there and look at thousands of companies day after day, and only when I see something I understand, and when I like the price at which it’s selling. Then if I swing, if I hit it, fine. If I miss it, it’s a strike, but it’s an enormously advantageous game. And it’s a terrible mistake to think you have to have an opinion on everything. You only have to have an opinion on a few things. In fact, I’ve told students if when they got out of school they got a punch card with 20 punches on it, and that’s all the investment decisions they got to make in their entire life, they would get very rich because they would think very hard about each one. And you don’t need 20 right decisions to get very rich. Four or five will probably do it over time. So I don’t worry too much about the things I don’t understand.

If you understand some of these businesses that are coming along and can spot things. If you can spot an Amazon for example. I mean it’s a tremendous accomplishment what Jeff Bezos has done. And I tip my hat to him. He’s a wonderful businessman, and he’s a good guy, too. But I couldn’t have anticipated that he would be the success and 10 others wouldn’t be? I’m not good enough to do that, but fortunately, I don’t have to. I don’t have to form an opinion on Amazon. And I did form an opinion on the Bank of America, and I formed an opinion on Coca-Cola. I mean Coca-Cola has been around since 1886. There’s 1.8 billion eight-ounce servings of Coca-Cola products sold every day. Now, if you take one penny and get one penny extra, that’s 18 million dollars a day. And 18 million times 365 is 7 billion three less 730 billion or six billion, 570 million dollars. So annually $6,570,000,000 from one penny. Do you think Coca-Cola is worth a penny more than Joe’s Cola? I think so. And I’ve got about 127 years of history that would indicate it.

So those are the kind of decisions I like to make. And you may have an entirely different field of expertise than I would have, and probably much more up to date in terms of the kind of businesses that we’re seeing evolve. And you can get very rich if you just understand and probably much more up to date in terms of the kind of businesses that we’re seeing evolve. And you can get very rich if you just understand a few of them and understand the future. But fortunately I don’t have to’’.1

Warren Buffet said this when he appearred alondside Brian Moynihan in Georgetown University in 2012